Research group, led by Prof. WEI Jiuchang from School of Management at the University of Science and Technology of China (USTC), uncovered that corporate reputation not always benefits the company, but is a double-edged sword when corporate crisis happens, advancing current understanding of the relationship between corporate reputation and firm’s economic performance, which has been one of the major concerns of reputation and crisis management research.

Corporate reputation has long been viewed as a company’s intangible asset. Both business managers and researchers would pay much attention to this asset. Previous research has called for more research on corporate reputation as a multidimensional concept and the possible interactions among these dimensions. The research group identifies two dimensions, generalized favorability and being known, and studies how attribution of crisis responsibility affects firm value at the start of a crisis. The work gives insights on business practices and contributes to current business literature. It finds that generalized favorability serves as a buffer, while being known can be a burden, in influencing firm value. Furthermore, it shows evidence that different dimensions of reputation have opposing effects on firm value at the onset of a crisis, contributing to the debate concerning the effect of corporate reputation. Thirdly, shareholders’ responsibility attribution is very important in determining their reaction to corporate crises. The research adds to the extant literature that has relied mostly on surveys or experiments covering only a few crises.

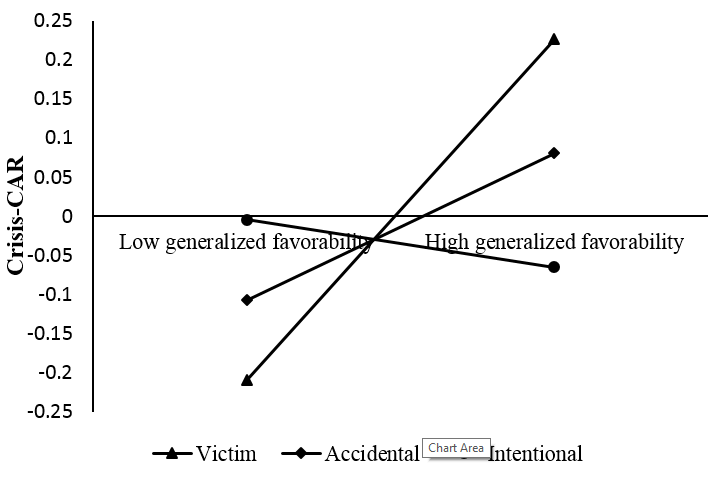

Therefore, when a crisis starts, a well-liked firm can rely on their generalized favorability among stakeholders and have less firm value loss, while a well-known firm should better communicate with stakeholders to reduce the loss. And firms should enhance their favorability and avoid too much attention on the crises. What’s more, a well-liked firm can further reduce the loss when the public attribute the responsibility to the firm less.

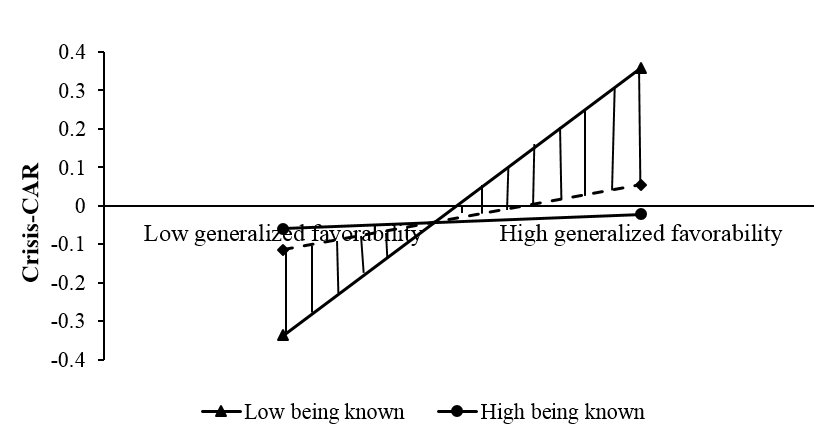

Figure 1. The interaction effect of generalized favorability and being known on Crisis-CAR (Image by WEI Jiuchang)

The two solid lines in figure 1 represent the lowest (=7.44) and highest (=9.59) levels of being known. The dotted line represents the switching point of being known (=9.16) below which the effect of generalized favorability is positive and significant (p<0 .05) but above which the effect of generalized favorability is not significant (p>0.1). This is done using the Johnson–Neyman technique (Spiller et al., 2013; Hayes, 2013). The shaded area thus represents the Johnson-Neyman region of significance.

Figure 2. The interaction effect of attribution of crisis responsibility and generalized favorability on Crisis-CAR (Image by WEI Jiuchang)

On Mar 23rd, the work was published (“WELL-KNOWN OR WELL-LIKED? THE EFFECTS OF CORPORATE REPUTATION ON FIRM VALUE AT THE ONSET OF A CORPORATE CRISIS” on Strategic Management Journal , one of UT Dallas top 24 business school journal.Strategic Management Journal is the world’s leading mass impact journal for research in strategic management, and The UT Dallas top 24 business school journal. University and research institutions of mainland China, as primary authors, published less than 5 papers in this journal. It is the first time for school of management to publish the paper in the top journal of strategic management field; it reflected another important breakthrough of the school of management in high level academic research. Dr. OUYANG Zhe of school of management and Prof. CHEN Haipeng (Allan) in Mays business school of the Texas A&M University are co-author. DOI: 10.1002/smj.2639)

This work lasted for three years, and was funded by the Youth Innovation Promotion Association of the Chinese Academy of Sciences (Social risk analysis and communication), and the first think tank research project of management science in the National Natural Science Foundation of China (Social security risk management research in China during ‘13th Five Year Plan’ ).

(School of Management Sciences)

Contact

Prof. WEI Jiuhang

weijc@ustc.edu.cn